43 officials from 19 countries participated in a regional workshop in Nairobi, Kenya in February 2024. It was organized by the IMF’s Fiscal Affairs Department and supported by the IMF’s regional technical assistance centers in Africa. The workshop brought together senior officials including Heads of Public Investment Units, Public Private Partnership Offices, Planning Commissions, and senior budget officials from Anglophone Sub-Saharan African countries to develop and exchange knowledge with peers and IMF experts on Public Investment Management (PIM). The workshop was structured around several themes discussed through lectures, peer presentations and exercises.

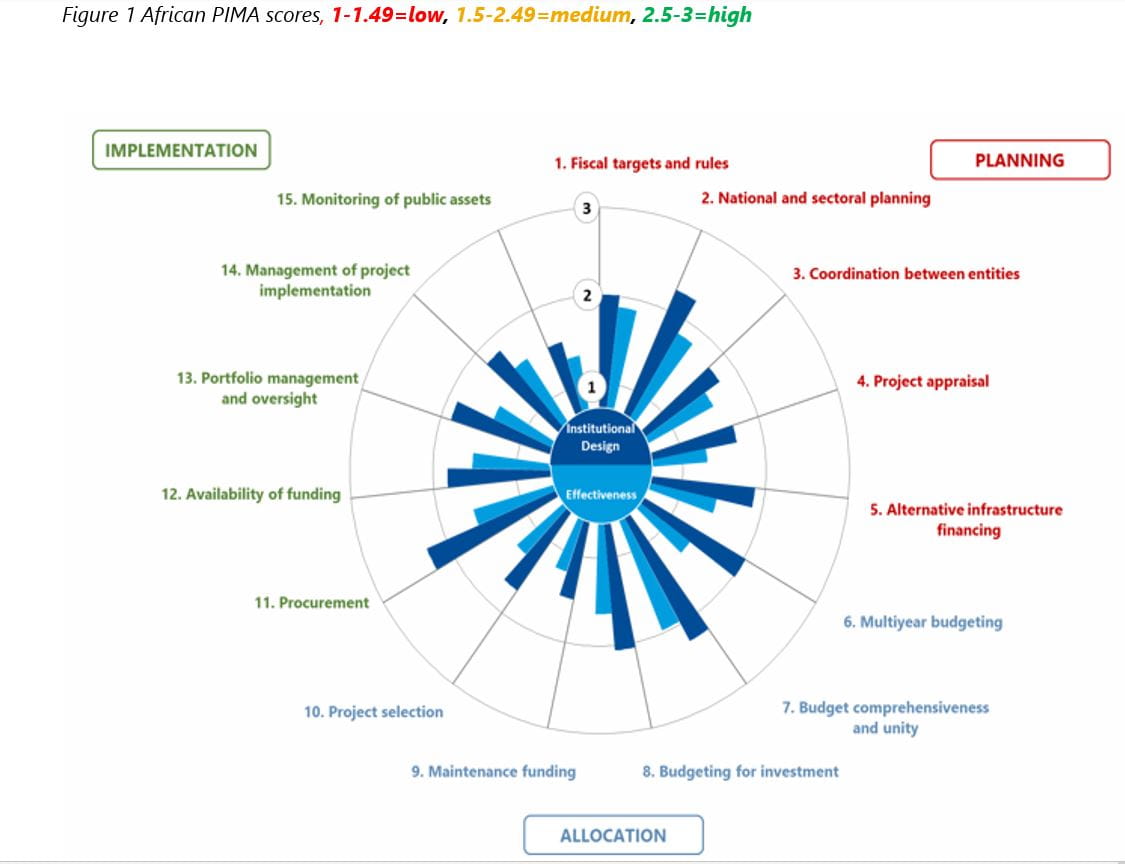

Based on recent PIM Assessments (PIMAs) from the region (Figure 1) several gaps were identified. While the design of PIM systems can overall be characterized as medium in terms of their average strength, the average effectiveness across the region is lagging. The key bottlenecks are commonly found in project appraisal, project selection, multi-year budgeting, maintenance funding, and the monitoring of public assets. In addition, participants identified poor capacity and gaps in the legal framework as areas of weakness in many of their countries’ PIM systems.

Each participating country took stock of its enabling PIM environment and developed a reform roadmap for the coming years, building on a similar exercise undertaken in November 2020.

Participants also undertook several specific hands-on exercises aligned with the PIMA findings and emerging themes such as climate change. The exercises included: (i) a spreadsheet-based project appraisal task covering financial and economic scenario analysis of a project; (ii) the role of public corporations in delivering infrastructure services and how to fund them; (iii) how to prioritize and select climate change related projects; and (iv) a role-playing exercise focused on key issues with respect to negotiating and evaluating unsolicited public-private partnership (PPP) proposals.

Some key takeaways from the sessions included:

- There has been a remarkable evolution in the vocabulary around PIM – there is now a widespread consensus on the meaning of key terms and the functions needed for good PIM.

- Upgrading the capacity of government officials to conduct robust and quantitative appraisal methodologies covering both economic and financial aspects of public investment is a priority.

- Public corporations play a vital and at times problematic role in the delivery of infrastructure which requires stronger legal frameworks governing the corporations as well as analytical skills to implement them.

- Climate change is an important topic, but the ability to assess its impact on projects and to identify projects that seek to mitigate climate change is still lagging.

- The idea of using PPPs to alleviate limited fiscal space and capacity challenges is still widespread, but interest may be waning in Africa. Experience shows that accepting unsolicited PPP proposals can lead to substantial fiscal risks. Good practice is to avoid such proposals and instead rely on the ordinary PIM process, hereby ensuring strong competitive tendering for prioritized projects, be they PPPs or procured by traditional means.

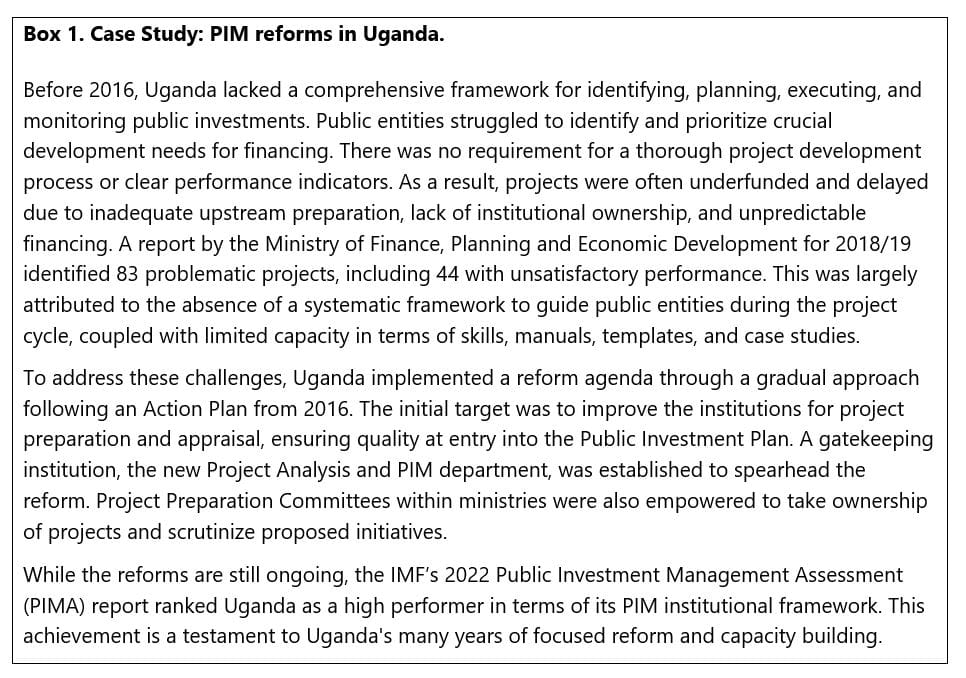

- Participating country officials contributed their experiences through presentations. The box below highlights the reform experiences of Uganda[1].

[1] Based on a presentation and materials delivered by Gertrude Basiima, an Assistant Commissioner Project Analysis, MoFPED, and Jim Mugunga, Executive Director, Public Private Partnerships Unit, MoFPED, Uganda.

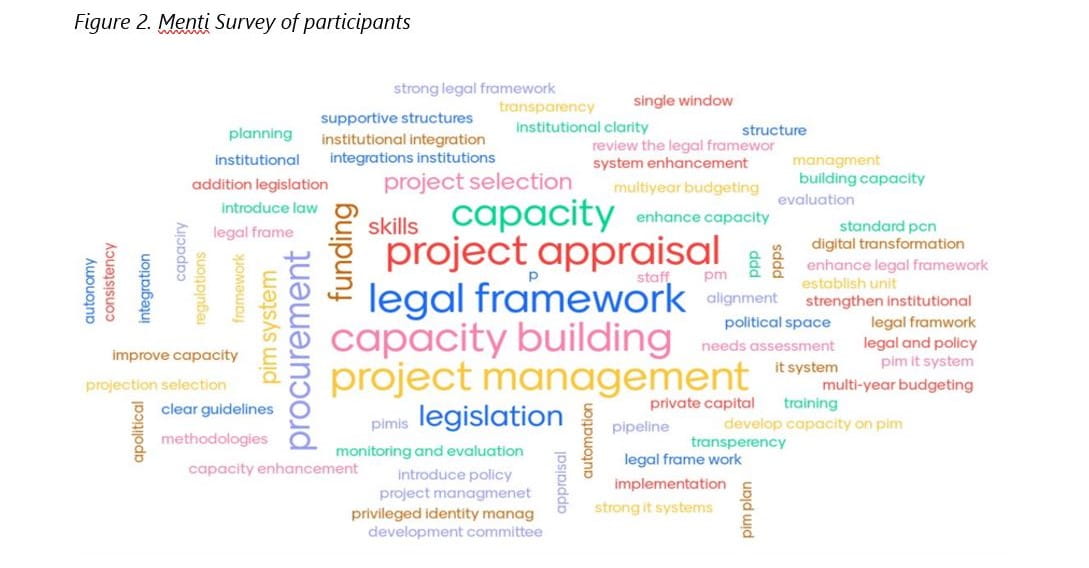

Figure 2 below, based on a survey of participants, shows what are considered as the most important reforms in the region.